Publication date:

Jul 23, 2025

IMF Data Brief: Financial Soundness Indicators

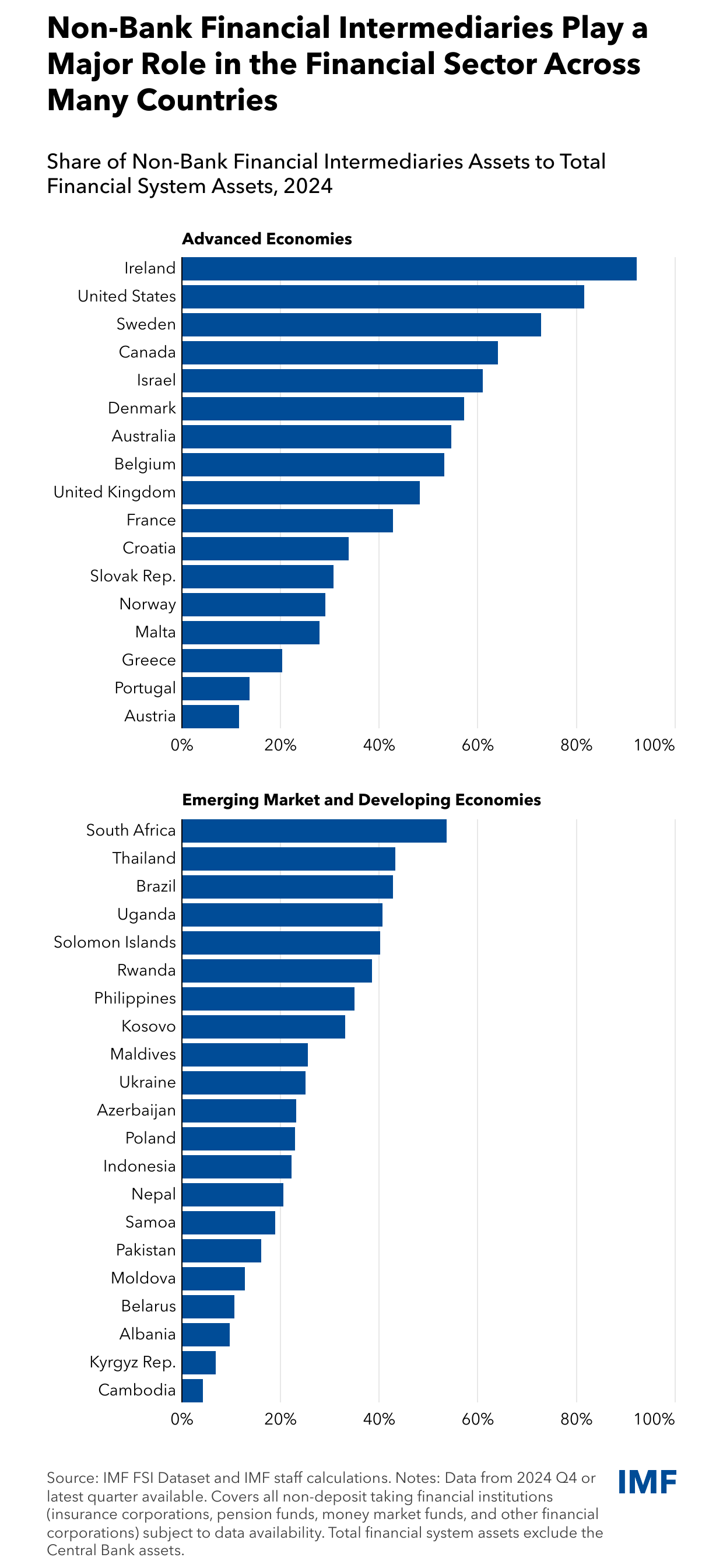

Non-Bank Financial Intermediaries Play a Major Role in the Financial Sector in Many Countries

Financial Soundness Indicators, Country data, Quarterly

(Contributors: Hector Carcel Villanova, Abdulrahman Gweder, Mahmut Kutlukaya, Miguel Segoviano, and Ibrahim Serwanja)

IMF’s Financial Soundness Indicators (FSIs) show that in many countries, non-bank financial intermediaries (NBFIs)—including insurance companies, pension and investment funds—represent a significant share of the financial sector, in some cases surpassing banks in terms of asset size. This tendency is more pronounced in Advanced Economies, where NBFIs tend to account for a larger share of financial system assets compared to Emerging Market and Developing Economies. Moreover, in many countries, the asset size of the NBFI sector has continued to expand over time, with significant growth over the past two years, highlighting the sector’s increasing systemic importance.

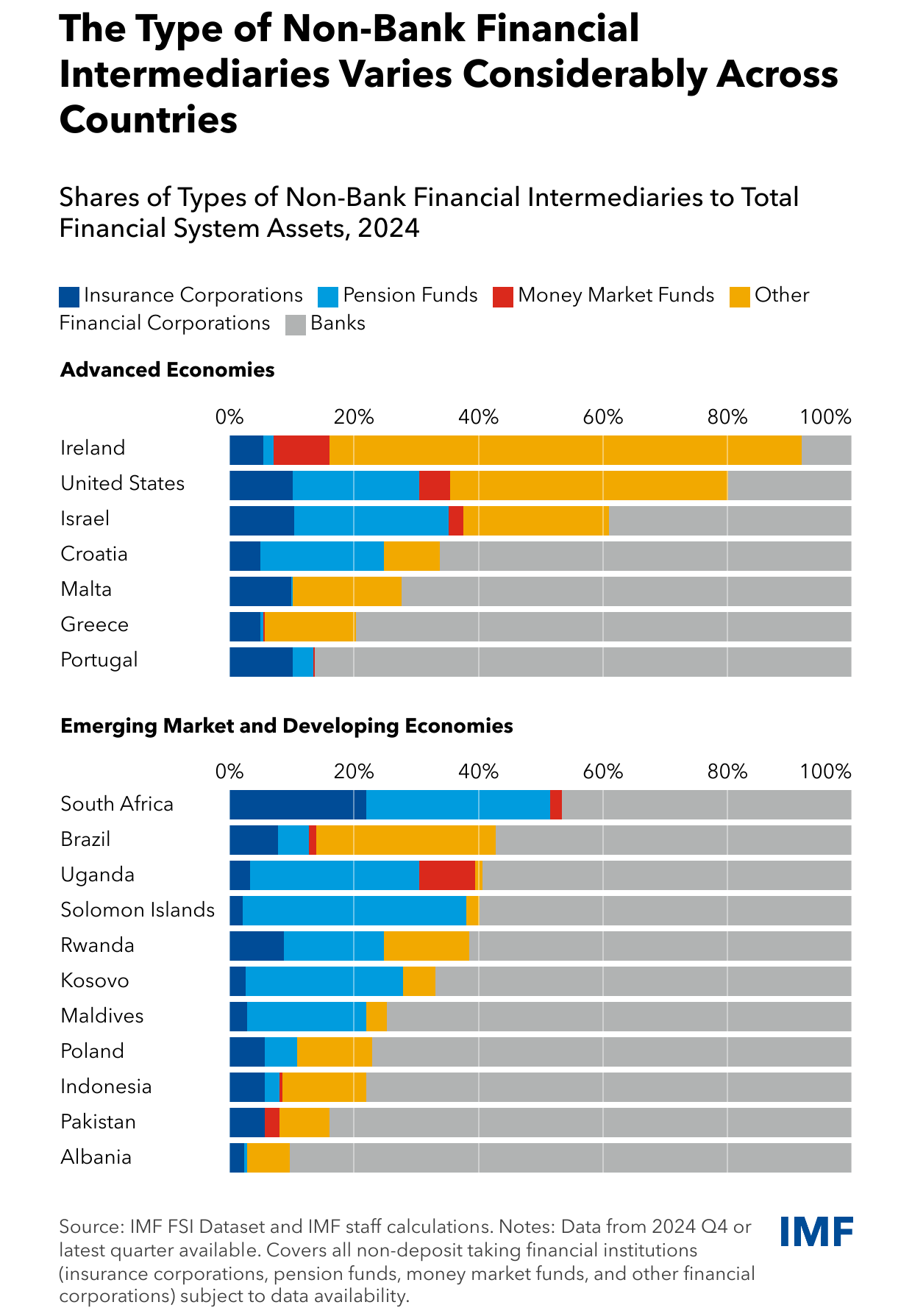

Notably, the relative weights of different types of NFBIs vary considerably across jurisdictions. Even within the same types of NBFIs, data reveal significantly different balance sheet structures across countries. Insurance corporations exhibit considerable variation in the composition of both assets and liabilities in terms of types of instruments. In contrast, pension and money market funds tend to have relatively similar liability structures due to the nature of their business models. Nonetheless, their asset compositions differ markedly across countries.

The above-noted differences in relative shares of NBFIs across countries, and the heterogeneity in their balance sheet structures, reflect significant differences in business strategies, risk-taking behavior, liquidity, maturity transformation and vulnerabilities. Hence, similar shocks can have widely varying effects across jurisdictions. This underscores the importance of careful and continuous monitoring of NBFIs, as their differing strategies—while possibly offering diversification benefits—may also pose specific risks to financial stability.

Notes: IMF's FSIs dataset provides data on the income statements, balance sheets, and memorandum series for NBFIs, including insurance corporations, pension funds, and money market funds.

EMPOWERING THE WORLD WITH DATA

IMF Data is known for its high standard of quality and methodological consistency. With over 50 datasets updated regularly, you always have access to the latest global economic trends and forecasts as well as trusted data for cross-country research and analysis.

Check our release calendar for upcoming releases: