Publication date:

Jan 28, 2026

IMF Data Brief: Monetary and Financial Statistics

Banks’ Credit Growth to the Public Sector Outpaces Private Sector Credit Growth in Asia and Africa

Monetary and Financial Statistics, Other Depository Corporations, Quarterly Data

Contributors: Aleksandra Alferova, Darja Milic and Huong Lan Vu

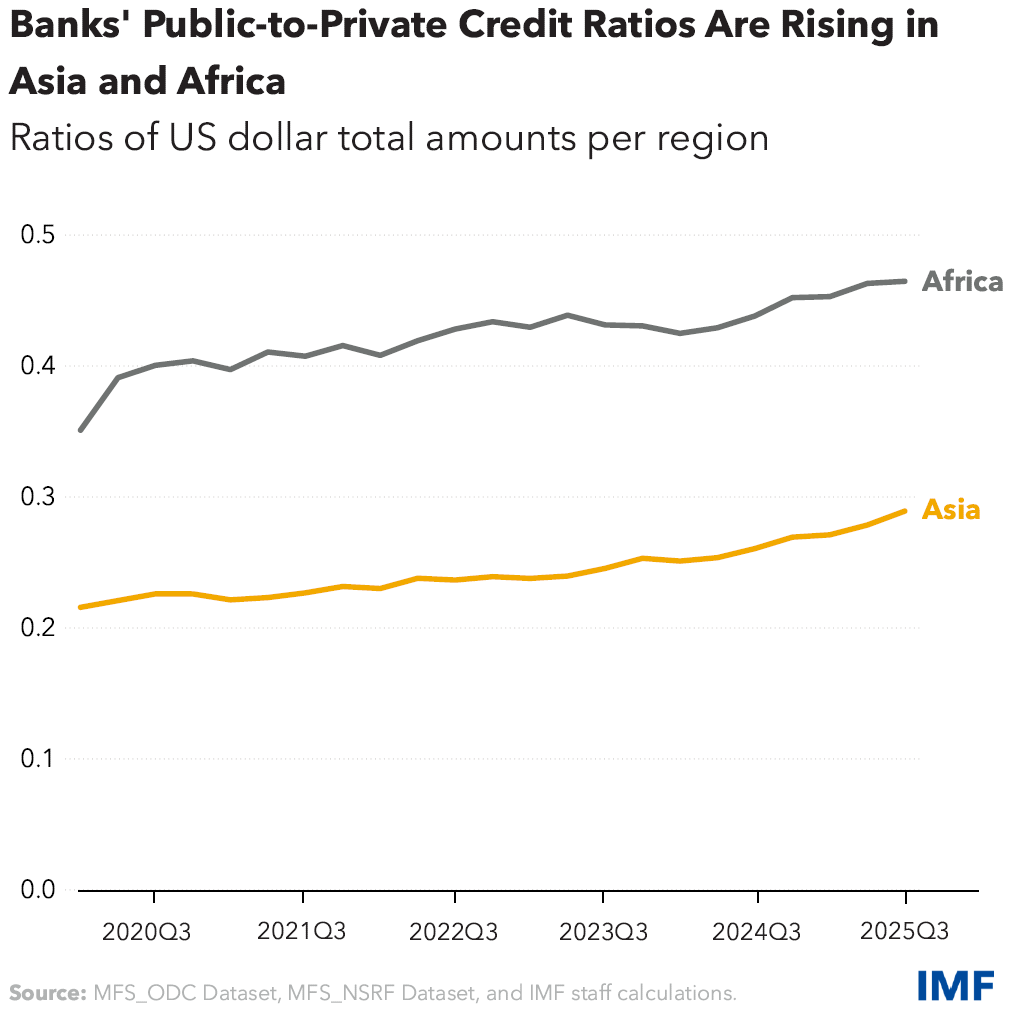

In Asia and Africa, bank credit to the public sector has grown faster than credit to the private sector in recent years, although developments differ across countries. This pattern continued through the first three quarters of 2025. A key risk associated with this divergence is the potential crowding out of private sector credit, particularly in economies with shallow banking systems and limited balance-sheet capacity.

In Sub-Saharan Africa, credit to the public sector amounted to nearly one-half of the credit extended to the private sector. By the end of the third quarter of 2025, public sector credit amounted to about 46 cents for every dollar of private sector credit, up from around 35 cents per dollar in 2020. At the same time, public sector credit increased by 13 percent compared with the same quarter a year earlier, while private sector credit grew by 7 percent. This widening gap reflects rising fiscal financing needs and greater reliance on domestic bank borrowing by governments, particularly in low-income countries where financial systems are smaller and alternative sources of financing are limited.

In the Asia-Pacific region, credit to the private sector remains substantially larger in absolute terms, but public sector credit has grown more rapidly. By the end of the third quarter of 2025, public sector credit stood at about 29 cents for every dollar of private sector credit, compared with roughly 22 cents per dollar in 2020. Private sector credit recorded annual growth of 5 percent at the end of the third quarter of 2025, while public sector credit expanded by 17 percent. This shift reflects elevated government borrowing during and after the pandemic, alongside more subdued private sector credit demand in some economies, and is evident across both low-income countries and emerging market economies.

Notes: The IMF MFS Dataset can be accessed on IMF Data Portal. The sample includes 8(12) Emerging Market and 22(7) Low-Income countries in Sub-Saharan Africa (Aisa-Pacific). The countries included are Angola, Botswana, Cabo Verde, Eswatini, Kingdom of, Mauritius, Namibia, Seychelles, South Africa (AFR, EME); Burkina Faso, Comoros, Union of the, Côte d'Ivoire, Gambia, The, Ghana, Guinea, Guinea-Bissau, Kenya, Lesotho, Kingdom of, Madagascar, Republic of, Mali, Mozambique, Republic of, Niger, Rwanda, São Tomé and Príncipe, Democratic Republic of, Senegal, Sierra Leone, South Sudan, Republic of, Togo, Uganda, Zambia (AFR, LIC); China, People's Republic of, Fiji, Republic of, India, Indonesia, Malaysia, Maldives, Mongolia, Philippines, Samoa, Thailand, Tonga, Vanuatu (APD, EME); Bangladesh, Bhutan, Cambodia, Nepal, Papua New Guinea, Solomon Islands, Timor-Leste, Democratic Republic of (APD, LIC).

Data for China is from non-Standardized Report Form. “Banks” refers to Other Depository Corporations (ODCs), which include all financial institutions excluding the central bank that incur liabilities considered part of broad money. Bank credit to the private nonfinancial sector includes loans, securities and trade credit and other receivables from private nonfinancial corporations, households and nonprofit institutions serving households, while credit to the Public Sector credit refers to Central Government, State and Local Government and Public Nonfinancial Corporations. To address missing data, the most recent available data point for each country is applied. Countries with more than two quarters of data missing are excluded from the sample. Credit growth is computed for each country relative to the same quarter in the previous year and then averaged across regions and income groups. Income group classification is based on the October 2025 WEO.

EMPOWERING THE WORLD WITH DATA

IMF Data is known for its high standard of quality and methodological consistency. With over 50 datasets updated regularly, you always have access to the latest global economic trends and forecasts as well as trusted data for cross country research and analysis.

Check our release calendar for upcoming releases: