Publication date:

Dec 16, 2025

IMF Data Brief: Direct Investment Positions by Counterpart Economy

The Appreciation of the US Dollar in 2024 Had a Significant Impact on US-Dollar-Valued Global Direct Investment Positions

Direct Investment Positions by Counterpart Economy, Annual Country Data and Country Group Aggregates, December 2024

Contributors: Malik Bani Hani, Mher Barseghyan, Maja Gavrilovic, Abdulrahman Gweder and Topias Leino

Direct investment (DI) positions decreased in 2024 (by 1.4 percent for inward DI), according to the Direct Investment Positions by Counterpart database (based on the Coordinated Direct Investment Survey).* This decline was primarily attributable to exchange rate valuation effects, i.e., the depreciation of the euro and several other currencies against the US dollar in 2024.

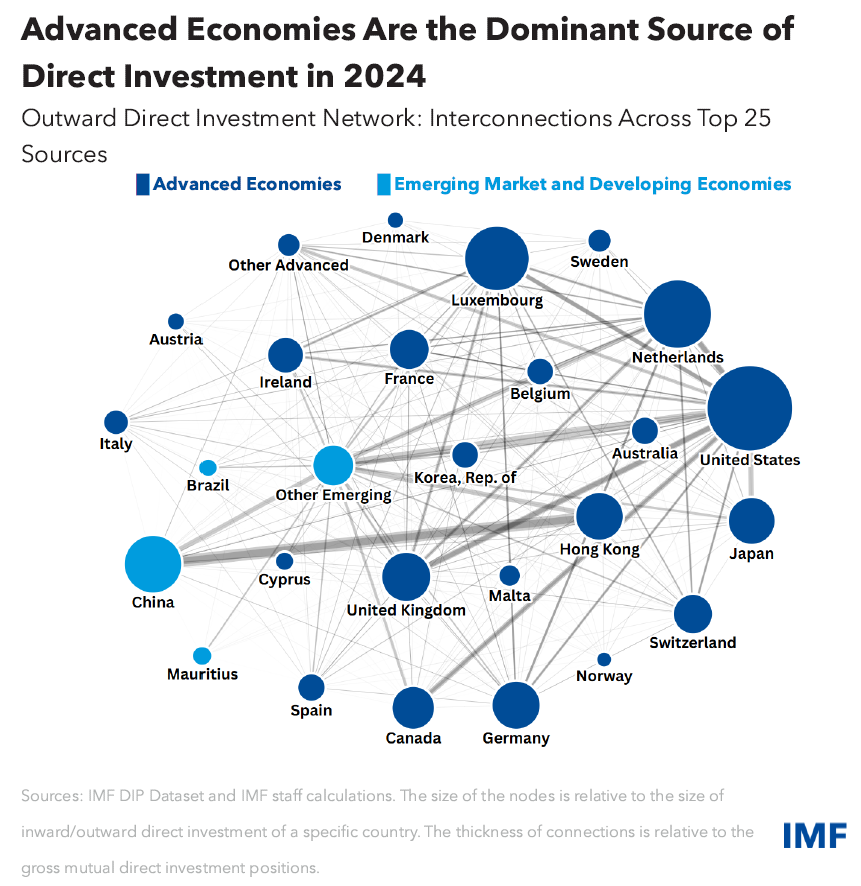

Many European economies recorded declines with Ireland, the United Kingdom and the Netherlands reporting the largest decreases in both inward and outward direct investment. In contrast, inward and outward DI positions increased significantly in the United States and Hong Kong. The United States, China, the Netherlands, Luxembourg and the United Kingdom remained the world’s top five destinations for (inward and outward) DI, collectively accounting for 45 percent of global inward direct investment positions and for 49.5 percent of global outward direct investment positions. China became the second-largest DI host economy as of end-2024.

Direct Investment in Emerging Economies Shows Divergent Trends

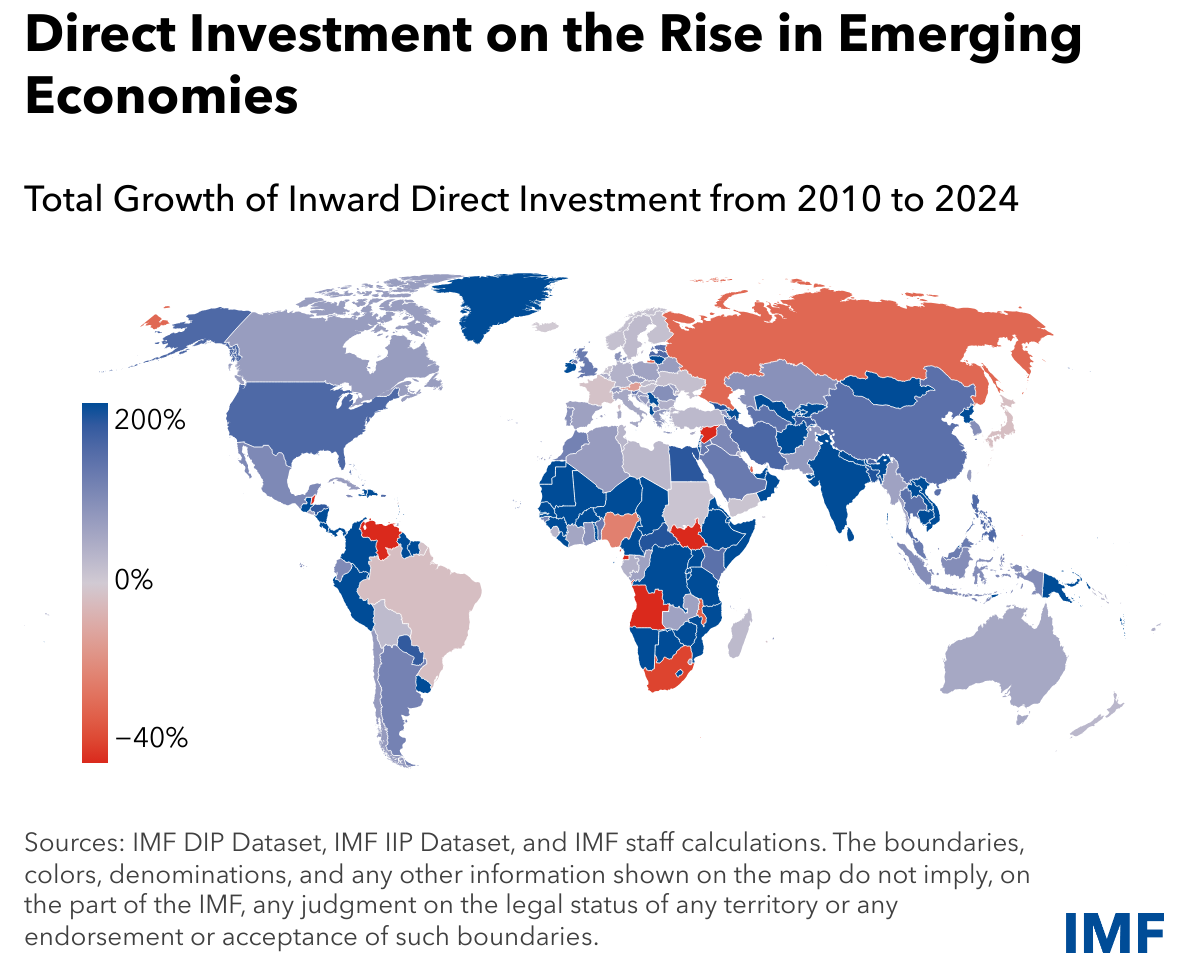

Emerging Market and Developing Economies (EMDEs) accounted for around 26 percent of the global inward direct investment positions at end-2024,** up by 1 percentage point since 2010. The total inward DI positions of EMDEs increased from 2010 to 2024 by 97 percent, while for advanced economies the increase was 79 percent. This increase is driven primarily by China, which represented roughly 25 percent of EMDEs’ total in 2010 and about 31 percent in 2024. Other major EMDEs, such as Mexico, India, and Brazil, have also emerged as top destinations for global direct investment in recent years.

The growth rates of direct investment in many EMDEs in Africa, Central and South America, and Asia have outpaced those of most advanced economies in recent years***. EMDEs narrowed the gap particularly after 2021, when their inward DI growth surpassed that of advanced economies in both absolute and relative terms. However, this trend has not been uniform, as some EMDEs, like Russia, Nigeria, and South Africa, experienced significant declines in their inward DI positions. In 2024, overall inward DI growth in EMDEs was close to zero.

Notes: The CDIS is an annual worldwide survey of bilateral DI positions conducted by the IMF’s Statistics Department since 2009. The CDIS database presents detailed data and metadata on inward DI (i.e., direct investment into the reporting economy) and outward DI (i.e., direct investment abroad by the reporting economy). 110 economies provided end-2024 data for the current CDIS cycle.

*Data and charts in this section, including individual countries and global aggregates, are based on the actual reported data during the current CDIS cycle.

**Data in this section, including estimates for the global total, growth rates and economies that have not reported CDIS data are estimated based on data reported to the IMF in the CDIS and the International Investment Position (IIP) statements.

***The growth rates for countries that have not reported in the CDIS are estimated based on IIP data and counterparty data of the CDIS.

OTHER RELEASES

International Trade in GoodsWorld and Country Aggregates, September 2025

International Trade in Goods for September 2025 was released on December 15, 2025. The dataset includes seasonally adjusted exports of goods aggregated for regions and the world. |

EMPOWERING THE WORLD WITH DATA

IMF Data is known for its high standard of quality and methodological consistency. With over 50 datasets updated regularly, you always have access to the latest global economic trends and forecasts as well as trusted data for cross country research and analysis.

Check our release calendar for upcoming releases: