About Financial Development Index

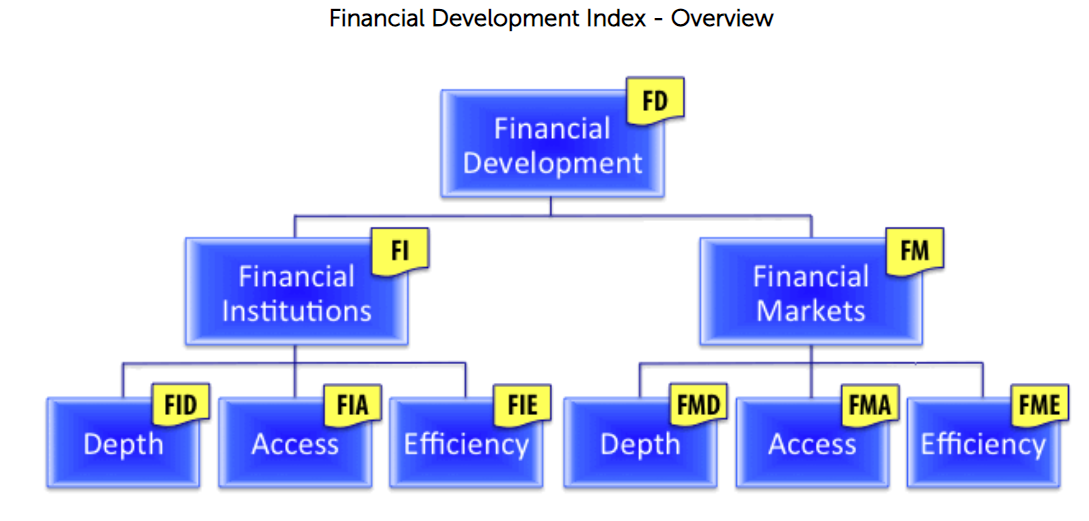

Financial Development Index is a relative ranking of countries on the depth, access, and efficiency of their financial institutions and financial markets. It is an aggregate of the Financial Institutions index and the Financial Markets index.

Financial Institutions index (FI) is an aggregate of:

- Financial Institutions Depth index (FID), which compiles data on bank credit to the private sector in percent of GDP, pension fund assets to GDP, mutual fund assets to GDP, and insurance premiums, life and non-life to GDP.

- Financial Institutions Access index (FIA), which compiles data on bank branches per 100,000 adults and ATMs per 100,000 adults.

- Financial Institutions Efficiency index (FIE), which compiles data on banking sector net interest margin, lending-deposits spread, non-interest income to total income, overhead costs to total assets, return on assets, and return on equity.

Financial Institutions index (FI) is an aggregate of:

- Financial Institutions Depth index (FID), which compiles data on bank credit to the private sector in percent of GDP, pension fund assets to GDP, mutual fund assets to GDP, and insurance premiums, life and non-life to GDP.

- Financial Institutions Access index (FIA), which compiles data on bank branches per 100,000 adults and ATMs per 100,000 adults.

- Financial Institutions Efficiency index (FIE), which compiles data on banking sector net interest margin, lending-deposits spread, non-interest income to total income, overhead costs to total assets, return on assets, and return on equity.